What’s next on the horizon for Bill Gates? Why, Spanish property, of course…

Bill Gates is not the coolest man in the world. He’s not the most fashionable, and he’s certainly not going to win many beauty contests. But what he does do better than most people is invest his time, insight and money wisely…

Not for nothing has he been called “The World’s Richest Man” for longer than anybody else. At Microsoft he foresaw how computers were about to change the world, and took advantage of the explosion in home PCs long before anybody else.

Since then he has smartly outmanouevred many other tech whizzes to stay atop of the game, while his charitable donations are among some of the most well-selected and impactful in the world.

So when Gates invested a (for him) modest €113.5 million into Spanish property in 2013, it raised a few eyebrows. After all, wasn’t property in Spain a busted flush? A post-boom battleground of distressed sellers, unshiftable, half-built urbanisations and vendors steadfastly refusing to lower their asking prices?

Well, for a time that description was at least partly accurate, but by 2013 Gates had recognised something that many others (VIVA excepted) had missed: Spain’s wider economics were beginning to show signs of recovery, and that is nearly always the best indicator of an impending upturn in property values.

This correlation between Gates’ foresight and Spain’s current economic revival was recently spotted by property portal Kyero, who have put together some handy data showing just how right Gates was to step into Spanish property when all others were looking elsewhere.

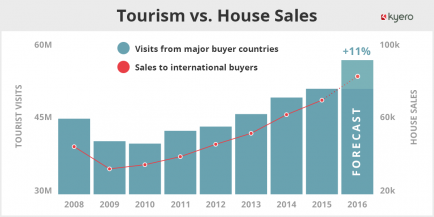

The most startling data shows how tourism and house sales in Spain are related. Since the depths of the global recession in 2010, the number of visitors to Spain from traditional ‘Buyer Countries’ (such as the UK, Germany, France and the Nordic countries) has risen steadily, as have property sales to these nationalities.

Data provided by Kyero.

Seems simple, right? But such trends are only obvious in hindsight. Gates had the foresight to see in 2013 that Spain’s economy was set to grow at a sustained rate for years to come, and knew what this meant for the property sector: it meant tourism would boom, and when tourists visit a country, memories are made and a desire to “return again and again” develops.

This in turn means that property enquiries begin to soar, which leads to more transactions, more interest, more confidence and – eventually – very welcome property price rises.

Kyero’s data shows that Spain and Germany’s GDP is growing 1.4% and 1.6% respectively. Stable and steady, sure, but the UK’s growth has surged ahead to 2.9% over the past few months. And which nationality visits and buys property in Spain more than any other right now? That’s right, the Brits.

Equally, with Russia’s economic growth limping along at 0.6%, the Russian property buyer in Spain has become rare.

Then there are those famously unsteady exchange rates. In 2008, the pound and the euro were almost at parity, meaning Brits looking to buy in Spain would have to pay £196,000 for an average €200,000 home. Today, Brits buying in pounds have 25% more purchasing power, while that same home in 2008 is around 31% cheaper today.

Do the maths and the result is obvious: Spanish property is around 50% more affordable for Brits in 2016 than it was in 2008. And as more Brits buy, word spreads – as has been seen this year as enquiries for Spanish property have boomed across most of the leading property portals.

And when Brits buy in Spain, not all of them relocate. The famous “Holiday Home” is great for those six weeks in the summer when it’s all yours, but savvy Brits often want to rent their property out in the other months. This market can be trickier to predict, but rising rents – tied to a stronger domestic economy in Spain – are being seen across many of the most popular regions, further strengthening the appeal of Spanish property.

The data, so clearly presented by Kyero, is something of an obvious secret hidden in plain sight: the correlation between cash-rich, happy holidaymakers and confident property investors is strong, and as Spain is set for a bumper summer (boosted by the threat of terrorism elsewhere along the Mediterranean), things are only going to get better.

So even if you’re no Bill Gates, have never been close to being a billionaire or savvy investors, this data cannot be ignored: for a sure thing, it pays to invest in Spanish property.

en

en

Vlaams-Nederlands

Vlaams-Nederlands

0 Comments

Leave a Comment

DISCLAIMER

The opinions and comments expressed by contributors to this Blog are theirs alone and do not necessarily reflect the views of VIVA Homes Under the Sun Ltd, any of its associated companies, or employees; nor is VIVA to be held responsible or accountable for the accuracy of any of the information supplied.

Have you got something to say?